The process of enhancing the value of Indonesian coal through conversion into substances like dimethyl ether (DME) hasn’t picked up steam, largely because it doesn’t make financial sense right now. This is partly because selling coal in its natural, unprocessed state as an energy source has been fetching good prices on the market lately. Both a clear set of regulations and a solid plan for shifting to cleaner energy are seen as critical for the growth of this industry sector.

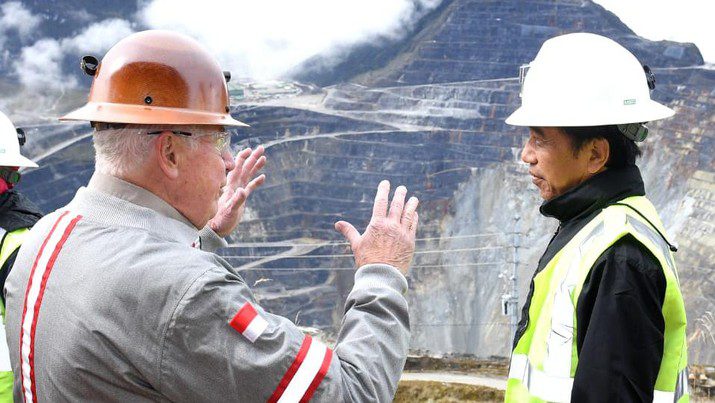

Optimism was sparked when the Indonesian President, Joko Widodo, initiated the country’s inaugural project to convert coal into DME in collaboration with Pertamina, a state-owned enterprise, and PT Bukit Asam Tbk in South Sumatra on January 24th, 2022. Air Products, a U.S. firm, was also involved. Yet, they withdrew their participation early in 2023, and a new partner has not been found since.

Bisman Bhaktiar, who leads the Center for Energy Law Studies and Mining (Pushep), remarked on Thursday (9/5/2024) that the Indonesian coal is typically sold in its basic form. With rising demand and consequently higher prices, there’s less incentive to process it any further. He pointed out that a big roadblock is the upfront cost; turning coal into DME needs a lot of investment in both high-tech setups and funding. He believes that this has prevented the sector from advancing as it has in the mineral industry.

Additionally, the infrastructure for a DME market is still in infancy, which causes uncertainty among investors and businesses interested in developing coal beyond its raw form. Bisman expresses that there’s potential for growth in this area, but the risks and factors to consider are significant, leading many to adopt a ‘wait and see’ approach.

Bisman also stressed the importance of legal stability, saying that for businesses contemplating such significant investments, it’s not just about profit or waiting for clearance, but knowing that their investment is protected. Even though there are incentives like a zero percent royalty, these have not proved tempting enough in practice. Furthermore, how this sector aligns with policies on transitioning to sustainable energy sources needs clarity, requiring a detailed strategic plan.

Arsal Ismail, PT Bukit Asam Tbk’s Director, echoed these sentiments during the company’s annual shareholder meeting on Wednesday (8/5/2024). He stated that while they’re examining the feasibility of coal gasification carefully, they must also consider its economic viability.

Arsal cautioned against allowing these efforts to derail the company’s financial health. Nevertheless, there’s no doubting the company’s commitment to supporting the government’s initiative to add value to coal. With abundant coal reserves available, the focus remains on finding suitable technology for converting coal into more valuable forms. There has been a setback due to Air Products withdrawing, although the company plans to press on with examining the possibilities.

At the same shareholder meeting, the company decided to distribute dividends of 4.6 trillion Indonesian rupiah, which represents 75% of their net profit from the fiscal year 2023. PT Bukit Asam Tbk’s revenue reached 38.5 trillion rupiah that year, with a net profit of 6.1 trillion rupiah, sustained by a production volume of 41.9 million tons – a noticeable increase from the previous year.

Arsal underlined that PT Bukit Asam Tbk’s future goals include maintaining the production at about 41 million tons in 2024, aiming to ramp up to around 50 million tons in 2025, and then almost 60 million tons in 2026, by implementing well-crafted business strategies to tackle global and domestic economic challenges, fostering more durable company growth.

The prospect of turning Indonesian coal into more useful forms, like dimethyl ether (DME), hasn’t taken off as expected. This is mainly because it’s financially more rewarding to sell coal as it is, especially when the prices are high in the market. Both a solid approach towards clean energy transition and specific regulations are deemed necessary for the industry to grow.

President Joko Widodo had started a coal-to-DME project involving Pertamina, PT Bukit Asam Tbk, and Air Products from the US in South Sumatra in early 2022. However, Air Products dropped out in early 2023, and a replacement hasn’t been found yet.

According to Bisman Bhaktiar from the Center for Energy Law Studies and Mining (Pushep), the basic sale of coal is still the go-to. The high cost of setting up the necessary technology for conversion and funding it has hindered progress compared to the mineral industry. Moreover, the uncertain market for DME discourages further development of turning coal into other products.

Bisman points out that despite the offering of a zero percent royalty, incentives haven’t been compelling enough for investors, stressing the need for legal security and a clear direction on how this initiative fits into the wider energy transition plan.

At the annual meeting of PT Bukit Asam Tbk, Arsal Ismail, the company’s director, shared that they’re cautiously evaluating the financial viability of coal gasification, ensuring it doesn’t compromise their financial stability. Despite challenges, they remain committed to the government’s vision of adding value to coal. The pullout of Air Products posed a setback, but they continue to explore technological solutions for coal conversion.

During the same meeting, the company announced a dividend payout of 4.6 trillion Indonesian rupiah, 75% of their 2023 net profit, following a reported revenue of 38.5 trillion rupiah. The production spiked to 41.9 million tons, marking a 13% increase over the previous year.

Arsal highlighted the company’s forward-looking plans to sustain production at about 41 million tons in 2024, with an aim to increase this to 50 million tons in 2025 and nearly 60 million tons by 2026. They are focused on deploying strategic business methods to navigate through global and domestic economic hurdles, aiming for continued sustainable growth.